risks associated with closed end funds

What are the risks associated with Closed-end Funds. Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below.

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

Prices might fluctuate from a high to a low value point in a.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

. 10 Best Closed-End Funds. Closed-end funds provide exchange-traded flexibility income potential ability to tap into specialized asset classes and lower investment minimums. A closed-end fund is an investment company that issues a fixed number of shares through an initial public offering IPO.

For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry. This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains. Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment.

For a list and explanation of fees associated with a. This often leads to closed. Get Answers Now Today.

With a fixed number of shares closed-end funds do not have ongoing costs associated with distributing issuing and redeeming shares as do open-end funds. Like a mutual fund a closed-end. CEFs are primarily designed.

The single biggest risk in ETFs is market risk. A closed-end funds shares have two sets of values. Find Out What You Need To Know - See for Yourself Now.

Answer 1 of 2. The two other main types of investment companies are open. Get this must-read guide if you are considering investing in mutual funds.

Ad Explore Closed End Mutual Funds. A closed-end fund is one of three main types of investment companies that the Securities and Exchange Commission regulates. Written by True Tamplin BSc CEPF.

A Primer On Risk for the Closed End Fund Investor. Closed-end funds can offer advisers. The assets of the fund a portfolio of securities are professionally.

Ad Learn why mutual funds may not be tailored to meet your retirement needs. Like a traditional open-end mutual. Closed-end fund definition.

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. Now we will discuss risks associated with CEFs. Closed-end funds raise a certain amount of money.

Ad Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals. What are the risks associated with Closed-end Funds. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds.

A closed-end fund or CEF is an investment company that is managed by an investment firm. Paying a Premium or Discount. Closed-end funds or CEFs are funds that manage money gathered from a pool of investors.

So if you buy an SP. As always it is important to consider the objectives risks charges and expenses of any fund before investing. All bond closed-end funds are subject to some degree of market.

Closed-end funds CEFs can be popular vehicles for portfolio diversification in the long-term although these funds come with certain volatility risks. Like any investment product closed-end funds come with a range of risks which well cover next. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC.

In secondary markets closed end fund shares are frequently accompanied by considerable trading volatility. As a result some income investors start buying into Closed End Funds CEFs. We researched it for you.

Current price and net asset value or NAV. Closed-end funds CEFs can be one solution with yields averaging 673. Updated on May 12 2022.

23 2011 751 AM ET ZF ETG GGN. It can also increase risk and can make the price of closed-end fund shares more volatile. Current price is what the shares are currently trading for on an exchange.

Get this must-read guide if you are considering investing in mutual funds. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. At year-end 2021 assets in bond closed-end funds were 186 billion or 60 percent of closed-end fund assets.

Ad Learn why mutual funds may not be tailored to meet your retirement needs. CEFs are sometimes described as ancestors to exchange-traded funds but CEFs have a fixed number of shares while ETFs can raise or lower the figure as demand changes. The risks associated with.

A Closed End Fund CEF is an investment company which is listed on an exchange and traded intraday at prices determined by supply and demand in the market.

What Are Closed End Funds Forbes Advisor

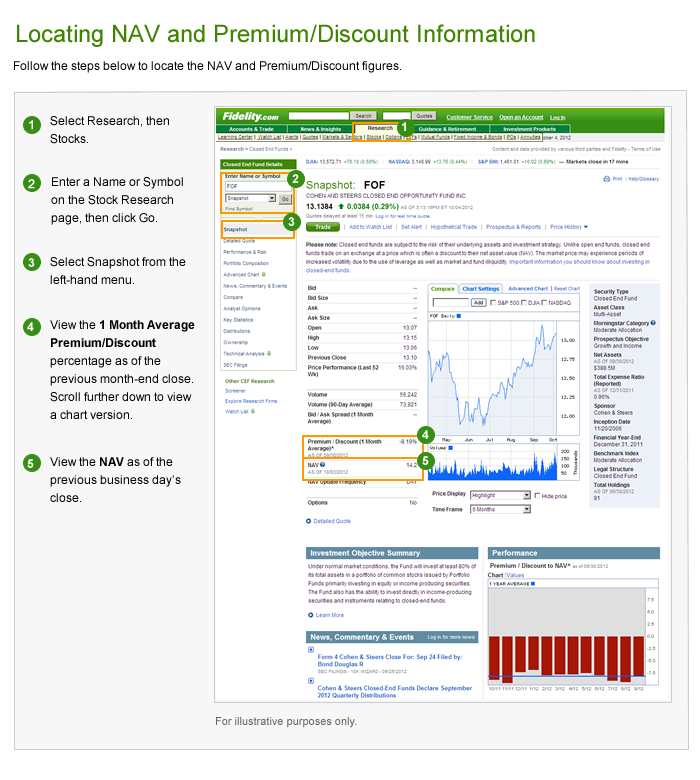

Closed End Fund Cef Discounts And Premiums Fidelity

Guide To Closed End Funds Money For The Rest Of Us

Guide To Closed End Funds Money For The Rest Of Us

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

What Are Closed End Funds Fidelity

Guide To Closed End Funds Money For The Rest Of Us

Rr Investors Offers Nfo Uti Capital Protection Oriented Scheme Series Iv I 1103 Days Http Goo Gl Bnxohr Mutuals Funds Investing Fund

Guide To Closed End Funds Money For The Rest Of Us

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Difference Between Open Ended And Closed Ended Mutual Funds

The Ultimate Closed End Fund Investing Guide 14 Criteria For Better Yield Investing Dividend Investing Investment Loss

What Are Closed End Funds Fidelity

Understanding Closed End Vs Open End Funds What S The Difference

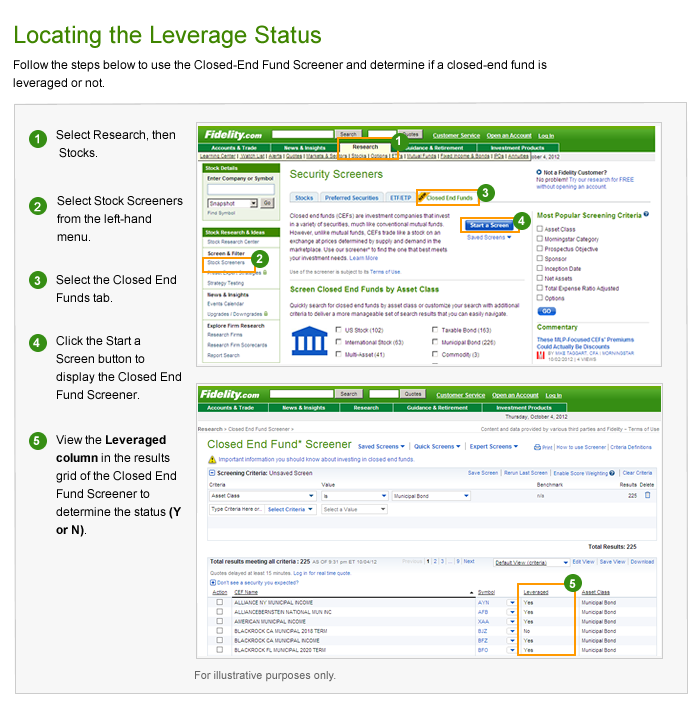

Closed End Fund Leverage Fidelity

Mutual Fund Mutuals Funds Mutual Investing

What Is A Closed End Fund And Should You Invest In One Nerdwallet

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)